The Alexandria Economic Development Partnership and our partner organizations are committed to ensuring Alexandria’s business community has the latest information on the impacts of COVID-19 and resources to help businesses respond. To sign up for our weekly newsletter and urgent news alerts, click here.

Virtual Meeting with the Small Business Administration (SBA): CARES Act Program Updates and Q&A For ALX Businesses

The Alexandria Economic Development Partnership (AEDP) and the Alexandria Small Business Development Center (ASBDC) are hosting a Virtual Meeting for Alexandria businesses to hear about CARES Act Program updates directly from the Small Business Administration. David Hincapie, Economic Development Specialist at the Washington Metropolitan Area District Office of the U.S. Small Business Administration (SBA), will discuss the financial tools and resources now available to help small businesses and non-profits navigate today’s unprecedented economic challenges.

This Virtual Meeting is for Alexandria, Virginia businesses specifically, and the majority of time is intended for questions from the ALX business community. Our goal is to make this an interactive session where businesses can get answers from the SBA and learn from what other local businesses are doing.

The meeting begins at 3:00 PM Eastern Time on Monday, April 20, 2020. You may join the conference 10 minutes prior. You must be registered in advance to attend the session. Please click here to register for the event.

Business Impact Survey

AEDP’s Business Impact Survey will close Tuesday, April 21. Businesses who have not completed the survey are encouraged to join the 450+ businesses that have shared information on the impact of the COVID-19 pandemic. AEDP is using this data to inform the City of Alexandria on ways to help businesses. Company and individual information will not be shared. The survey can be accessed here. Thank you to all of the businesses who have already taken the time to complete the survey; this important data helps us better serve the Alexandria business community.

Business Counseling & Assistance

Alexandria Small Business Development Center

The Alexandria Small Business Development Center (SBDC) is here to help small businesses affected by the COVID-19 crisis. More information can be found at the SBDC’s COVID-19 webpage.

Disaster Assistance for Businesses

Federal Relief Programs Suspended (UPDATED – April 16)

The U.S. Small Business Administration announced yesterday it is unable to accept new applications at this time for the Paycheck Protection Program (PPP) or the Economic Injury Disaster Loan (EIDL- including EIDL Advances)-COVID-19 related assistance program due to a lapse in appropriations. EIDL applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis. U.S. Treasury Secretary Steven T. Mnuchin and U.S. Small Business Administration Administrator Jovita Carranza have requested additional funds for both programs. Updates on the status of the programs will be sent as they are provided.

U.S. Small Business Administration (April 10)

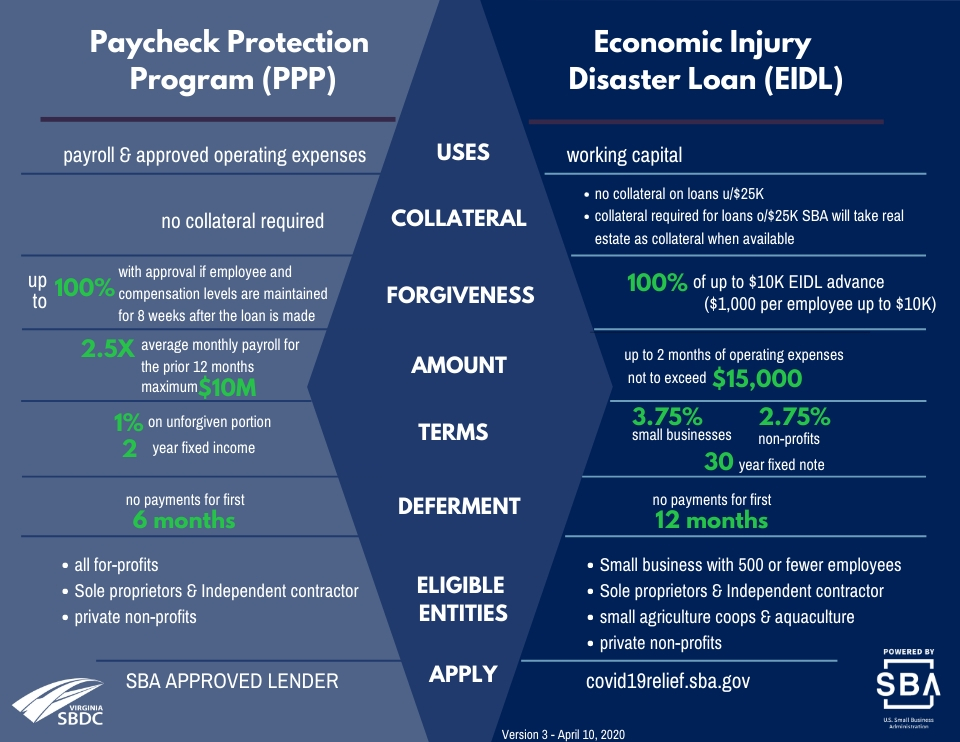

Alexandria businesses are eligible for disaster assistance through multiple programs administered by the U.S. Small Business Administration. A helpful summary and infographic highlight key programs available to small businesses. For assistance applying for these programs please visit the Alexandria SBDC’s COVID-19 webpage or email help@alexandriasbdc.org.

- Economic Injury Disaster Loans (EIDL) (Currently Suspended): the SBA’s EIDL Program provides working capital in the form of low-interest federal loans for small businesses with 500 or fewer employees, sole proprietors, independent contractors, and private non-profits.

- NEW – loan amounts have been capped at $15,000. Businesses are now eligible for loans of up to 2 months of operating expenses not to exceed $15,000.

- Businesses can request an EIDL advance up to $10,000 ($1,000 per employee up to $10,000) which is 100% forgiven

- To apply visit the SBA’s online portal

- For assistance with applying to this program email help@alexandriasbdc.org.

- Paycheck Protection Program (PPP) Loans (Currently Suspended): the application process for the Paycheck Protection Program (PPP)loans opened on April 3, 2020 for small businesses, sole proprietorships, and 501(c)(3) organizations. The PPP program provides 100% federally guaranteed loans for payroll costs (including benefits), interest on mortgages, rent, and utilities. The benefits of this program include:

- Keeping Employees on the Job – loans cover 2.5x average payroll for a period of 8 weeks

- Up to 100% Forgiveness – loans will be fully forgiven with approval if loans are used for payroll and other approved costs, and employee and compensation levels are maintained.

Applicants should take the following action to apply for a PPP loan:

- Contact your bank to determine 3 key things:

- Verify that they are an SBA 7(a) lender – if they are not, find a lender that is 7(a) approved

- When they are accepting applications – some banks are delaying the opening for applications so confirm the date

- How the application process will work – each bank will have a unique process

- Complete the two-page application, and

- Submit your application to your bank or another SBA 7(a) lender in accordance with their application procedure.

The Treasury Department has provided a Borrowers Fact Sheet that contains detailed information on the program. We encourage you to also consult with your bank or lender to learn about their application process and deadlines.

- Small Business Debt Relief Program: This program will provide immediate relief to small businesses with non-disaster SBA loans, in particular 7(a), 504, and microloans. SBA will cover all loan payments on these SBA loans, including principal, interest, and fees, for six months. This relief will also be available to new borrowers who take out loans within six months of the President signing the bill into law.

- Employee Retention Payroll Tax Credit: provides a fully refundable 50% credit on the employer’s share of payroll taxes on wages of up to $10,000 per employee. We are still working to understand this tax credit and identify resources for businesses.

- Delayed Payment of Employer Tax Credit: defers payment of employer payroll taxes through the end of this year until December 31, 2021 (50% due) and December 31, 2022 (remaining 50% due). We are still working to understand this tax credit and identify resources for businesses.

U.S. Department of Labor (March 31)

The Families First Coronavirus Response Act (the second federal stimulus bill) requires certain employers to provide their employees with paid sick leave or expanded family and medical leave for COVID-19 related reasons. The Department of Labor has released guidance and FAQs to explain who is covered and for how long.

Tax & Regulatory Changes

Business Closure Extended Until May 8th, Stay At Home Order Remains In Effect Until June 10th (UPDATED – April 16)

Governor Northam announced he is extending the closure of non-essential businesses until Friday, May 8. Executive Order Fifty-Three originally signed on March 24, bans crowds of more than 10 people; closes recreation, entertainment, and personal care businesses; and limits restaurants to offering takeout and delivery services only. Governor Northam’s Executive Order Fifty-Five, which directs Virginians to stay home unless they must leave for essential services, remains in effect until June 10.

- Essential businesses that were permitted to operate under Executive Order Fifty-Three, such as grocery stores and dining establishments with carryout options, may continue to operate.

- The Stay At Home order directs all Virginians to stay home except in extremely limited circumstances. Individuals may leave their residence for allowable travel, including to seek medical attention, work, care for family or household members, obtain goods and services like groceries, prescriptions, and others as outlined in Executive Order Fifty-Three, and engage in outdoor activity with strict social distancing requirements.

- Previously, the Governor’s Office released a Frequently Asked Questions sheet to clarify Executive Order 53 which was signed earlier this week. The Governor’s order mandated the closure of certain non-essential businesses while restricting operations for businesses like restaurants, grocery stores, and other retail operations. The Virginia Department of Health has also posted FAQs to help business owners.

Governor Northam Issues Stay at Home Order Until June 10th (March 30)

Governor Northam issued a statewide Stay at Home order to protect the health and safety of Virginians and mitigate the spread of COVID-19. Executive Order Fifty-Five took effect yesterday and will remain in place until June 10, 2020, unless amended or rescinded.

- The order directs all Virginians to stay home except in extremely limited circumstances. Individuals may leave their residence for allowable travel, including to seek medical attention, work, care for family or household members, obtain goods and services like groceries, prescriptions, and others as outlined in Executive Order Fifty-Three, and engage in outdoor activity with strict social distancing requirements.

- Essential businesses that were permitted to operate under Executive Order Fifty-Three, such as grocery stores and dining establishments with carryout options, may continue to operate under the Stay At Home Order.

- Previously, the Governor’s Office released a Frequently Asked Questions sheet to clarify Executive Order 53 which was signed earlier this week. The Governor’s order mandated the closure of certain non-essential businesses while restricting operations for businesses like restaurants, grocery stores, and other retail operations. The Virginia Department of Health has also posted FAQs to help business owners.

Virginia ABC Delivery/Take-Out of Mixed Drinks and License Renewal (April 10)

- Guidance for Delivery/Take-Out of Mixed Drinks: restaurants with mixed beverage licenses and distilleries with approved tasting rooms are now able to provide delivery services and take-out mixed drinks. This temporary privilege, effective April 10. Virginia ABC issued the following restrictions on this temporary policy:

-

- Distillery licensees are limited to a maximum of two mixed drinks per delivery or takeout order that contain 1½ ounces or less of spirits per drink.

- Mixed beverage restaurants and limited mixed beverage restaurants are limited to four cocktails for each delivery or take out sale. Each order for delivery or takeout of cocktails must include a meal for every two cocktails purchased.

- Cocktails shall be packaged in a glass, paper or plastic container (or similar disposable container) or in a single original metal can with a secure lid or cap designed to prevent consumption without removal of the lid or cap (lids with sipping holes or openings for straws are prohibited).

- All recipients of delivery orders must be at least 21 years of age.

- Deferment of Annual ABC Licensee Renewal Fees: The Governor directed Virginia ABC to defer license renewal fees for 90 days from original expiration date for establishments with licenses expiring in March, April, May and June. Additional details can be found here.

Updated Guidance for Food Establishments (March 26)

The Virginia Department of Health released new Guidance for Food Establishments: Restrictions on Public Gatherings and Social Distancing. According to the guidance:

- To further mitigate the spread of this virus, effective March 24, 2020 at 11:59 PM food establishments are mandated to offer curbside takeout and delivery service only, or close to the public.

- The mandated closure of congregation areas in these facilities signals that gathering inside to pick up food is not permitted. State interpretation is that this means the facility employees should take the product outside for pick-up orders.

- Food service must be limited to service of food intended for off-premise consumption only, and seating of patrons on the premises (indoors or outdoors) is eliminated.

- Take-out orders should be delivered curbside by the food establishment employee(s). In order to protect patrons and employees, patrons should not enter the food establishment.

Alexandria Business Tax Changes (March 26):

On Tuesday, March 24, City Council enacted tax policy changes to help Alexandria businesses during the COVID-19 emergency. A summary of those changes is below. Details can be found on the City’s Finance Department website. Affected business owners with specific questions about these changes are encouraged to contact the City’s Revenue Division by email at Businesstax@alexandriava.gov.

- Delayed payment of 5% Meals Tax collected by Restaurants & Grocery Stores: for the approximately 490 restaurants and grocery stores in Alexandria, the City Council approved a temporary moratorium on charging late payment penalties and interest on the Meals Tax. This allows those businesses to hold on to the taxes they collected from customers between the time period of February 1, 2020 – June 30, 2020, and defer the payment to the City after the moratorium ends. It will also allow those businesses to enter into payment plans of the deferred taxes, without penalties or interest, provided they are paid in full by June 30, 2021.

- Delayed payment of 6.5% Transient Lodging Tax and $1.25 per night tax collected by Hotels, Motels & other Hospitality Businesses: for the approximately 50 hotels, motels, Airbnbs and bed and breakfasts in Alexandria, the City Council approved the same temporary moratorium described above for the Meals Tax.

- Extension of Business Personal Property Tax Return Filing Date: for the 8,000 businesses and organizations in the City of Alexandria that are required to file a tax return that identifies their personal property (furniture, fixtures, and equipment) subject to taxation, City Council moved the filing deadline from May 1 to July 1. The business personal property tax returns will be required to be filed online through the City’s Business Tax Portal. The due date for Personal Property tax payments was not changed from the regular due date of October 5.

- BPOL Tax 2020 – 2nd Quarter Payment Deferred: if a business has elected to pay tax year 2020 taxes on a quarterly basis, the 2nd quarterly payment, normally due May 1, 2020, has been deferred to January 8, 2021 (this is a one-time change only). The 2nd quarterly payment may be made next January without the additional handling fee of 5%.The 3rd quarterly payment will remain due on August 1st, and the 4th payment will be due on November 1st. Normal handling fees apply.

- BPOL Tax 2020 – Late Taxes: tax year 2020 BPOL taxes were due March 1, 2020. If a business has not yet paid the 2020 liability, payment may be deferred during the COVID19 moratorium, until June 30, 2020. Payment of the full amount must be paid at the end of the COVID19 moratorium. While a late payment penalty will not be charged during the moratorium, late interest will continue to accrue as required by state law. Payment after the moratorium can also be paid according to a payment plan, again with interest. Refund of taxes already paid on BPOL is not applicable.

Restaurant Operations (March 19):

- Until further notice, the City has suspended enforcement of certain regulations and special use permit conditions that limit hours of operation, deliveries, off-premises alcohol sales, and outdoor sales and dining.

Parking (March 17):

- The City has suspended enforcement of parking restrictions for residential street sweeping and for the prohibition on vehicles parking on the street for more than 72 hours. All other posted parking restrictions, including residential permit time limits and parking meters, remain in effect.

State Taxation

- The Virginia Department of Taxation is extending the due date of payment of Virginia individuals and corporate income taxes. While filing deadlines remain the same, the due date for individual and corporate income tax will now be June 1, 2020. Please note that interest will still accrue, so taxpayers who are able to pay by the original deadlines should do so.

Support for Affected Workers

Workers who have been impacted by the COVID-19 pandemic can file for Unemployment Insurance through the Virginia Employment Commission (VEC) at https://www.vec.virginia.gov/unemployed or by calling 866-832-2363. To learn how to file a UI claim, applicants can watch this video or review this tip sheet.

- To access the $600 per week Pandemic Unemployment Assistance (PUA) – a special federal supplement to traditional unemployment assistance – workers must first apply through traditional unemployment by visiting www.vec.virginia.gov or www.vawc.virginia.gov.

- After filing an initial claim, claimants must continue to file a weekly certification each following week in order to be paid. This can be done by calling the interactive voice response line at 1-800-897-5630 or through your online account at www.vec.virginia.gov or www.vawc.virginia.gov. VEC recommends you do this on Sunday, Monday, or Tuesday of each week if you remain unemployed and want to be paid for the prior week.

Additional Benefits

To apply for benefits like SNAP, TANF, or Medicaid go to the Virginia Department of Social Services or call 855-635-4370 (to renew your Medicaid by phone call 855-242-8282).

Resources for Job Seekers

The City of Alexandria’s Workforce Development Center is providing virtual services to job seekers and is posting job announcements on the WDC’s jobs board. The WDC can also direct individuals to other benefits offered by the City of Alexandria. To learn more visit https://www.alexandriava.gov/WorkforceDevelopment or call 703.746.5990.

Community Resources

Act for Alexandria has created a list of emergency response resources.

Government

- The City of Alexandria has a dedicated COVID-19 webpage with updates and links to information on the local response to COVID-19.

- City Council is continuing to meet – their schedule can be found on the City’s Calendar. To view the docket, watch the live stream, or view archived meetings, please visit the Dockets and Webcasts page.

- For information on the State’s response, visit Commonwealth’s COVID-19 website.

- Click here for the latest press releases from Governor Ralph Northam.

How to Support ALX Small Businesses

- Last week, Visit Alexandria launched a new community resource, ALX at Home, to keep locals and those in the nearby region connected to ways they can still support our local businesses from the comfort of their own home. From curbside pickup at restaurants to virtual ghost tours; from FaceTime shopping to virtual fitness classes, local restaurants, shops and attractions are tapping into their creativity to find new ways to bring their businesses to the community.

- The Chamber ALX is updating their COVID-19 page with updates from their members to track updates, delivery methods, specials, and more information.

Support, Questions, and Recommendations

If you have a question or are a struggling business owner we want to hear from you. Email us and one of our staff members will respond.

We also want recommendations on how we can better serve the business community- please feel free to send us your suggestions.

Official COVID-19 Resources